April 2022

Private Wealth Capital Markets Update: Quarter One 2022

It was a difficult quarter for investors as equity and fixed income allocations experienced negative returns. In our quarterly review, we discuss inflation, the recent yield curve inversion and likelihood of a recession.

INFLATION

INFLATION

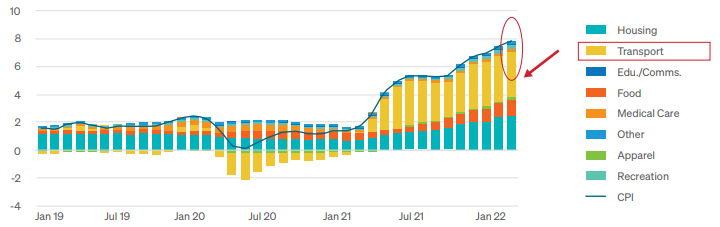

Inflation continues to climb and is now at 40-year highs. Figure 1 shows that transportation was a detractor to inflation in 2020 and early 2021, but transportation is now a key driver in the rise in inflation. The year-over-year growth will become more difficult in the future, and we are closer to peak inflation. While we expect inflation to moderate through this year, we expect the supply chain bottlenecks and strong demand to keep inflation elevated above the Fed’s 2% target.

CAN INFLATION SUSTAIN AT THIS RATE?

ROUGHLY ONE-HALF OF THE CONTRIBUTION TO INFLATION IS COMING FROM MORE CYCLICAL, SUPPLY CONSTRAINED CATEGORIES

SOURCE: COLUMBIA THREADNEEDLE

YIELD CURVE INVERSIONS

YIELD CURVE INVERSIONS

YIELD CURVE INVERSIONS AND FORWARD RETURNS

SOURCE: BLOOMBERG & STRATEGAS

AVERAGE S&P 500 PERFORMANCE FOLLOWING YIELD CURVE INVERSIONS

SOURCE: BLOOMBERG & STRATEGAS

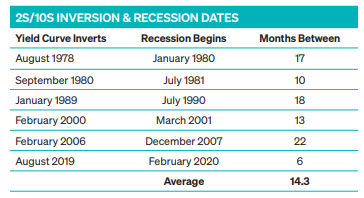

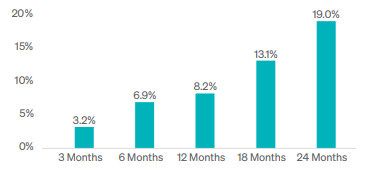

The yield curve is an excellent predictor of a recession, but it lacks predictability in terms of magnitude and duration. Figure 2 illustrates that when looking back at previous recessions, there is an average of 14 months after the inversion of the 10-year Treasury and 2-year Treasury before a recession starts. While many investors are quick to move defensive on a yield curve inversion, history has shown that it can be detrimental to portfolio performance. Markets have historically outperformed in the years following an inversion.

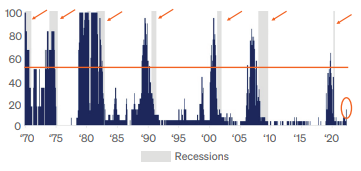

In our analysis of yield curve inversions, we place greater weight on the percentage of points on the yield curve that are inverted. Figure 3 shows that historically, it is difficult to avoid a recession when over 50% of points are inverted.

In our analysis of yield curve inversions, we place greater weight on the percentage of points on the yield curve that are inverted. Figure 3 shows that historically, it is difficult to avoid a recession when over 50% of points are inverted.

PERCENTAGE POINTS ON INVERTED YIELD CURVE

SOURCE: STRATEGAS

PORTFOLIO REVIEW

FIXED INCOME ASSET CLASS YIELDS AND Q1 RETURNS

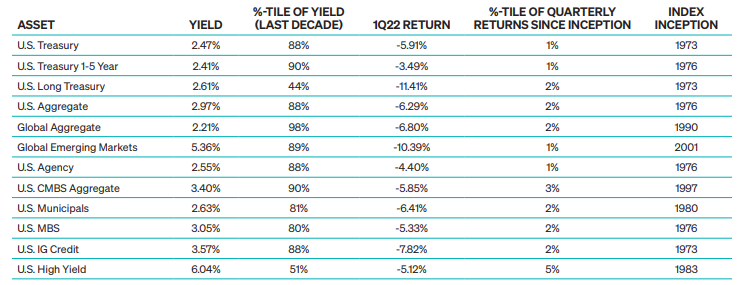

The sharp rise in rates and spreads negatively impacted fixed income asset classes. Figure 4 shows how there really was nowhere to hide this past quarter. This has led many investors to question whether fixed income still makes sense in their portfolio. Interestingly, when you look at the percentile rank of the quarterly returns since inception, this was one of the worst quarters ever for many fixed income benchmarks. “Income” has finally returned to fixed income. As shown in the chart, the US Bond Aggregate is yielding nearly 3% and US Municipals are yielding 2.63%, which is over 4% on a tax adjusted basis for investors in the highest tax bracket. High yield bonds are yielding 6%. With the sharp rise in yields, investors are receiving greater income to support returns. Fixed income remains a valuable asset class for income and volatility mitigation. It has been a challenging quarter that tested investors’ abilities to maintain longer term objectives. Over the course of the year, we expect inflation to moderate but remain above the Fed’s 2%. The sharp move higher in yield has priced in many of the upcoming Fed hikes. We continue to monitor economic indicators and market conditions for changes to portfolio positioning. Our team remains dedicated to analyzing market trends and indicators to determine the optimal positioning of client portfolios.

FIXED INCOME RETURNS

QUARTERLY LOSSES THAT HAVE NEVER BEEN SEEN BEFORE

SOURCE: BLACKROCK

WHAT IS MEEDER PRIVATE WEALTH?

Meeder Private Wealth is our customized separately managed account (SMA) which is managed with a strategic investment discipline. As we look at the core components of private wealth, it is important to note that we have a vast ability to customize. This is not a one size fits all approach. Each client is unique with their own goals and objectives, so each portfolio is built specifically to that client’s unique situation. Additionally, as we move through time and the client’s goals and objectives change, Private Wealth has the flexibility to adjust and change as needed. We take a holistic approach to risk management, we want to know as much as possible about each client’s financial situation. The more information we have about their entire financial picture, the more effectively we can manage their investments and ensure we are maintaining their specific risk profile. We have the ability to manage around concentrated positions, excluding stocks, sectors, or industries. All this information can be taken into consideration as we are building the portfolio and allows our team to build the portfolio to be as effective and efficient as possible while maintaining the agreed-upon risk profile. An area that we would consider to be one of the most underserved from a portfolio management standpoint is tax management, which often represents a large part of our conversations with advisors and clients. We implement active and ongoing tax-loss harvesting, as well as gain deferral when needed. The tax loss harvesting isn’t simply selling stocks that are down at the end of the quarter or the end of the year. This is a more thoughtful approach where every account is reviewed daily to determine if there are opportunities within the portfolio to harvest losses. This active tax management allows us to maximize after-tax wealth for our clients and generate tax alpha. Finally, this is a transparent and unbiased approach. While Meeder does offer a full suite of mutual funds, we do not use any proprietary products inside of private wealth. Also, the clients will always be able to see in real-time the positions that are being held in the account, along with access to our investment team as needed to answer any questions that may arise.

The views expressed herein are exclusively those of Meeder Investment Management, Inc., are not offered as investment advice, and should not be construed as a recommendation regarding the suitability of any investment product or strategy for an individual’s particular needs. Investment in securities entails risk, including loss of principal. Asset allocation and diversification do not assure a profit or protect against loss. There can be no assurance that any investment strategy will achieve its objectives, generate positive returns, or avoid losses.

Commentary offered for informational and educational purposes only. Opinions and forecasts regarding markets, securities, products, portfolios, or holdings are given as of the date provided and are subject to change at any time. No offer to sell, solicitation, or recommendation of any security or investment product is intended. Certain information and data has been supplied by unaffiliated third parties as indicated. Although Meeder believes the information is reliable, it cannot warrant the accuracy, timeliness or suitability of the information or materials offered by third parties.

Investment advisory services provided by Meeder Asset Management, Inc.